The typical SaaS company grows faster, loses more money, and has a higher valuations than product sale companies.

| Weighted Average | Profitability | Cash Flow from Operations | Growth | Price/Revenue Ratio |

| Public SaaS Companies | -8% | +15% | 33% | 8.7x |

| Public Software Companies | +8% | +28% | 8% | 3.3x |

Source: SEC filings – weighted average by company revenue

Many factors drive the high-growth of SaaS companies, including higher market adoption of SaaS and the structural advantages of the recurring subscription revenue model – see Why SaaS Companies Grow Faster.

High-growth SaaS companies are often unprofitable. Revenue Acquisition Costs (the Sales and Marketing costs to add new revenue) are paid in advance, but the revenue recognized under GAAP rules, is deferred over the duration of the SaaS revenue stream. However, many unprofitable SaaS companies are cash flow positive because of the upfront SaaS payments by B2B clients.

This article examines the tradeoff between profits and growth, and how to make the right choices.

SaaS Companies Trade Profits for Growth

All companies make tradeoffs between profits and growth. If a company expands into a new geography, the benefits of that investment in new sales could take years. For product sales companies, once the sales are made, the investment is repaid more quickly. For SaaS companies, the investment is not recouped until after years of initial SaaS revenues.

Deferred revenue = deferred profits

SaaS companies have similar up-front revenue acquisition expenses as product sale companies, but these up-front investments coupled with long-term returns delays the revenue and profits. Unlike capital investments, GAAP doesn’t allow for the amortization of the Revenue Acquisition Costs over the life of the subscription revenue stream delaying the accounting profits.

The faster the SaaS growth, the larger the ratio of Sales and Marketing expenses to recurring revenue.

SaaS revenue is ultimately greater than from Product Sales

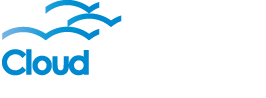

For example, if the Annual Recurring Revenue (ARR) from a SaaS is one-third of the revenue from a similar product sale, the revenue generated would be equal after three years and then increase in subsequent years.

There is a greater value in the SaaS revenue stream than a product sale even after adjusting the value of the recurring revenue stream by the projected impact of churn and the cost of capital (since a dollar obtained in the future isn’t worth a dollar received today).

In this example, the projected Net Present Value (NPV) of the revenue from a specific customer (adjusting for projected churn and the cost of capital) exceeds that of a product sale.

The greater the SaaS growth, the greater the percentage of customers who haven’t yet generated sufficient profits to pay back their acquisition costs, resulting in loses.

SaaS Company Profits Increase as the Customer Life Increases

The average “life” of the customer for a SaaS company depends on the time the company has had customers and the amount of churn. Clearly, a company that has been shipping a SaaS product for a year will have an average customer life of under a year, while a company that had customers for 10 years will have a much older average cover life. Churn reduces the average customer life since the older customer who churn must be replaced with new customers.

If the SaaS company has been around “forever” its Average Customer Life is:

![]()

The lower the churn, the greater Average Customer Life which increases the SaaS company’s profits.

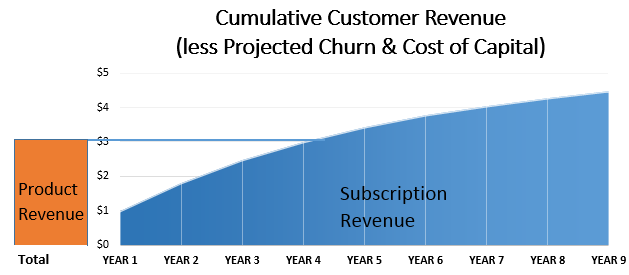

Of course, most SaaS companies haven’t been around “forever.” The Average Customer Life increases with the time since the first customer sale.

The following chart shows the progression of average customer life of customers for companies which have been delivering SaaS from one to ten years, at 10% and 15% average customer churn.

A company which is growing its base by 80% to 90% per year has half their customer of a life less than one-year – they will not have generated significant portion of their Life Time Value nor will have been profitable for the company yet.

The Key Metrics to Balance Growth and Profitability

The two metrics which allow the SaaS company to balance growth and profitability are:

- The Growth Efficiency Index (GEI)

- The Recurring Profits Margin (RPM).

Recurring Profits Margin (RPM)

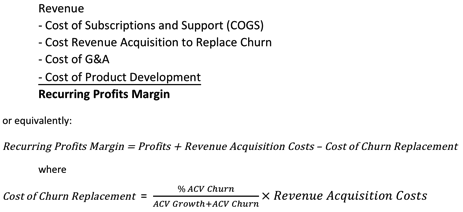

The Recurring Profits Margin is the projected profit the SaaS company would make with zero growth. That includes all company expenses except those related to the cost of growth (Sales & Marketing) above the level required to replace churn.

The lower the churn, the lower the cost of churn replacement, which improves the RPM. Once the SaaS company achieves the efficiencies of scale, the target RPM should be above 20% funding growth and improving profitability.

As long as the Recurring Profits Margin is positive, these margins can be invested in revenue growth.

Growth Efficiency Index (GEI)

The GEI efficiency Index is the Sales and Marketing cost (plus any unreimbursed direct onboarding costs) to add one dollar of Annual Contract Value (or Annual Recurring Revenue) of SaaS revenue.

![]()

A lower GEI means the company is more efficient at bringing in new customer or expansion revenue from existing customers. Companies with low GEIs have a lower cost of growth.

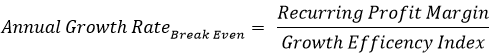

Balancing Profits versus Growth

SaaS companies can control their profitability by the amount they spend on revenue acquisition.

When SaaS companies spend exactly their Recurring Profits on revenue growth, they will break even. The formula which determines the break-even growth rate is:

Few SaaS companies would willingly choose to sacrifice growth for profits. The subscription company can choose between profitability and growth on a continuum based on the extent of revenue acquisition spending.

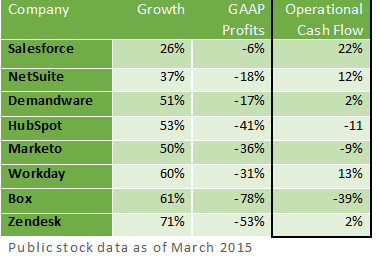

Public company data shows the tradeoff they have made between profits and growth for many high profile SaaS companies:

Cash Flow is a Better Measure of Short-Term Financial Health

The ability for SaaS companies to thrive in the short-term depends much more on cash flow than profits. If a company is cash flow positive, it can thrive without the need for additional investments.

The short-term analysis for public SaaS companies is much more positive focusing their operational cash flow (ignoring discretionary cash investments such as acquisitions). Profits are also lowered by non-cash expenses such as stock option expensing that can materially reduce the state profitability of many high-growth companies.

High-growth, B2B SaaS companies operational cash flow is more favorable than their profitability due to their prepayment of subscriptions. Successful B2B SaaS companies such as NetSuite, Workday and HubSpot require prepayment of one year or more of the subscription costs. Pacific Crest Survey reported that the private subscription companies they surveyed had a median prepayment of 3 months.

SaaS prepayments dramatically improve cash flow, though the revenue cannot be recognized immediately. Since B2B subscription contracts rarely have early termination rights, the revenue is assured.

Optimizing the Choice between Profits and Growth

Growth is good, but at what cost?

There are three primary financial criteria for choosing between profits and growth:

- The ROI of the revenue acquisition expense,

- The impact of company valuation

- The ability to benefit from economies of scale in areas such as COGS and development expenses to achieve higher profitability.

Another consideration for driving growth is the value of establishing greater market share early in expanding markets. Generally, the top two or three companies ultimately garner most of the market profits – investing early in growth can help ensure the company’s long-term market dominance.

Optimizing the ROI on Growth

Growth is a valuable company attribute, but the value of that growth depends on the future value of the new customers. That depends on their Customer Lifetime Value (CLV) which is the Net Present Value (NPV) of their SaaS revenue stream.

![]()

WACC, the Weighted Average Cost of Capital, is the discount rate (interest) on the value of future revenue.

Generally, the CLV is defined the value of the existing SaaS contract(s). More sophisticated models will take into account the probability of increasing the subscription value over time through customer expansion.

The money spent on growth Sales and Marketing (excluding the cost of churn replacement) should be approximately 25% to 33% of the future value of the SaaS revenue stream. By comparison, public software companies have a median cost of Sales and Marketing of 23% — SaaS companies will have additional expansion revenue to achieve these software company Sales and Marketing expense benchmarks.

If the growth Sales and Marketing expenses are greater than the 30% of the Customer Lifetime Value, the ROI may not be sufficient to adequately fund all other operating expenses over the life of the customer. If the growth potential of the customer is substantial, a higher ratio of Sales and Marketing to the current Customer Lifetime Value may be justified.

Maximizing the company valuation

SaaS companies have much higher price/revenue valuations than product sales – 8.7x versus 2.3x revenue valuations.

These higher valuations are based on the value of growth together with the favorable attributes of the SaaS model including:

- Investors calculate the Net Present Value of the recurring revenue stream (CLVs) and account for this in their valuation models.

- Company valuations are heavily influenced by growth and SaaS companies grow much faster the product sale companies.

- Investors believe the SaaS model has greater long-term value.

- Financial markets see customer demand shifting to SaaS models; they invest where the demand is going.

The financial markets value what not in GAAP

The future value of the recurring SaaS revenue stream is highly valued by investors – see Why Investors Love SaaS Companies. The high average valuations of SaaS companies are a result of the financial analysis of the future SaaS revenue stream.

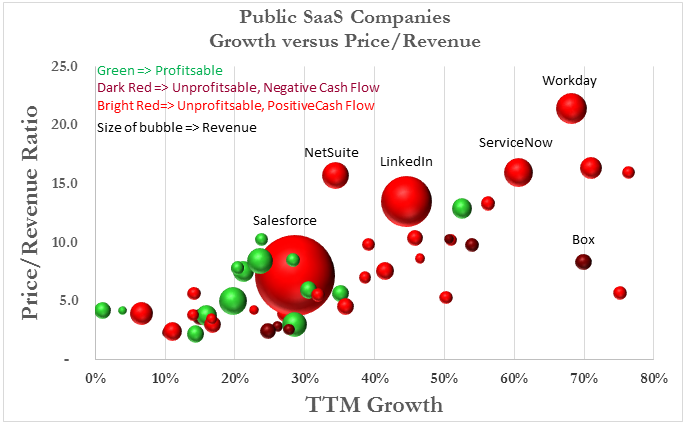

The following chart shows the relationship between growth and the Price/Revenue ratio of public SaaS companies.

While there are a great number of factors determining the valuation of a SaaS company, higher growth correlates with increased company valuation.

On average, for every additional 10% of SaaS company growth, the company valuation increases an incremental 1.6x of revenue.

If SaaS companies can grow efficiently (with a good ROI expenses of growth), the increased valuation will reward their shareholders richly.

The value of market leadership

In every market, a few companies garner the majority of the market. The market leaders are usually more profitable. Companies should strive to achieve market share in their market segment in the range 10% to 30%. Companies should invest sufficiently in growth to be a leader for long-term success.

The efficiencies of scale

Larger companies can reduce the percent of revenue spent in Research and Development, Marketing, and Administration as they scale. The cost of SaaS services should decrease substantially as many of the fixed costs associated with providing the SaaS services decrease as a percent of revenue.

These efficiencies of scale enabled by the company’s growth will ultimately increase the Recurring Profits Margins, profits and cash flow.

These tradeoffs will change at each stage of the company.

This article has simplified the analysis assuming the cost of growth is the same for all sales – they are not. Some of the ratios will improve due to the efficiencies of scale. The Growth Efficiency Index will also improve as the customer base becomes larger and more revenue is derived from expansion sales to the customer base and customer referrals, both which have a lower cost of sales than new customers.

The higher the growth rate, the higher the average cost of sales as the lowest costs sales opportunities are targeted first.

The growth versus profits analysis should consider these factors beyond adopting an overall simplistic model. The balance between growth and profits will definitely change over time.

Conclusion

Where there is the opportunity to grow a SaaS business, the SaaS company should act as long as there is a strong ROI on the growth investment. This growth will be gated by the cash availability, which is a greater practical barrier to growth than profits.

If the opportunity for hypergrowth exists, investments are easier to obtain.

Don’t let GAAP profitability metrics more applicable to low-growth product sale companies cloud the value of SaaS growth – investors don’t.