SaaS companies grow much faster than SaaP (Software as a Product) companies. Public SaaS companies grew at 28% in 2014 versus 8% for SaaP companies (Software Equity Group). According to the Pacific Crest SaaS Survey, private SaaS companies grew even faster at a median rate of 37%.

There are four primary reasons for this much higher growth:

1. The SaaS market is growing much faster than the SaaP market

“The use of cloud computing is growing, and by 2016 this growth will increase to become the bulk of new IT spend.”

Gartner

Customers want Software as a Service, not as a Product. This is the driver of SaaS’ extreme growth. SMBs are not as tightly wed to their existing software as enterprises, so their “switching” costs are proportionally less – SMBs led the early adoption of B2B SaaS.

Enterprises want SaaS, but have large investments both in the software and the training of their legacy applications. The majority of new applications in the enterprise will be SaaS based according to Gartner.

2. Deferring revenue accelerates growth

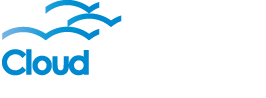

The SaaS business model and accounting rules defer SaaS revenue; Revenue from a SaaS customer is initially less than product revenue, but grow larger after the recurring revenue surpasses the revenue from product sales. Only if churn is out of control, the subscription revenue may end before it surpasses software product revenue. The lower the churn, the greater the advantage of the SaaS model.

This revenue for each SaaS customer which comes in later in their lifecycle adds to the SaaS company’s growth.

3. Each SaaS sale creates incremental growth

If a SaaP companies sells a million dollar of software in one quarter, it must sell at least a million dollars the next quarter or it will have negative revenue growth. If a SaaS company sells a million dollar of Annual Contract Value (ACV) in one quarter, and then sells the same amount the following quarter, it will grow because that contracted value (less any churn) is additive to the prior recurring revenue.

The SaaP company’s revenue is a function of the number of new customers while the SaaS company’s revenue is a function of the total number of customers.

As the SaaS company adds more customers, each new customer creates a stream of revenue to grow upon, not having to exceed the prior sales to grow.

A product company selling the same amount each quarter doesn’t grow, while the SaaS company does.

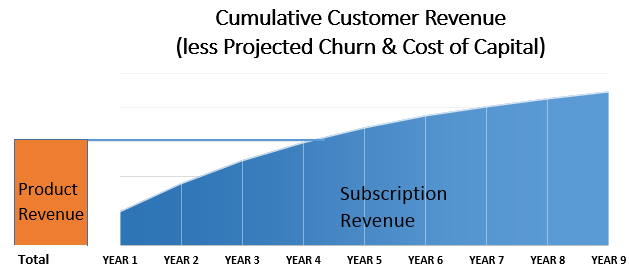

If the SaaP company has the same sales each period, the company’s growth is zero. The SaaS company with the same sales continues to grow by the new ARR offset by churn. This results in the revenue from the SaaS model ultimately exceeding SaaP.

Low Growth:

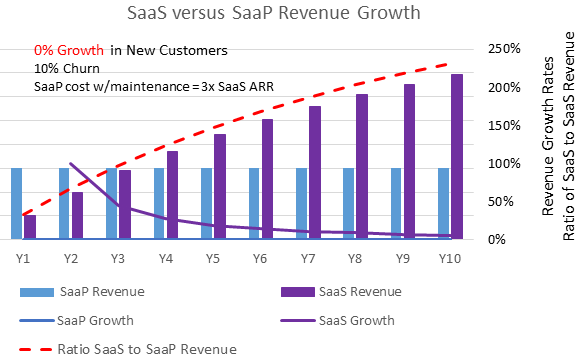

Revenue dominated by SaaS recurring revenue stream.

Paradoxically, in the scenario with rapid customer growth, the SaaP company will grow near-term revenue faster than the SaaS company because it is receiving all of its product revenue at the time of the sale. The SaaS company is deferring most of the revenue from new sales, however the company is growing its recurring revenue base which will yield long term revenue growth. The value of this recurring revenue will become apparent as growth slows and the value of the recurring revenue exceeds the value of new sales. The rapid building recurring revenue stream will payoff in higher future revenue for the SaaS company relative to the SaaP company as the rise in new customers slows.

High Growth:

The SaaS structural model of building new revenue on top of the existing recurring revenue yields higher long term revenue and growth potential.

The ratio of growth between SaaS and SaaP companies adding a large number of customers is lower during this high growth stage because the SaaS company is growing the future recurring revenue stream faster than it is growing its current revenue. As growth tapers, the ratio of revenue of the SaaS and SaaP company shifts dramatically to the SaaS company.

SaaS Expansion Revenue (discussed below) increases this ratio of SaaS growth to SaaP growth.

4. SaaS Companies have more Expansion Revenue

“25% of the revenue growth from SaaS companies with over $25m in annual revenue is from “Expansion Revenue.”

Pacific Crest Survey 2014

SaaS companies perfected the “Land and Expand” strategy. The nature of SaaS reduces the “Time to Value” with shorter implementation times and the ease of expanding existing customers adding to revenue growth.

There are fewer barriers to selling SaaS since there is less fear of lock-in to an expensive, complex, and difficult to install software. Once a SaaS company has a foothold in a company, it is easier to expand generating more revenue growth than for SaaP. The SaaS company first builds a customer base and then leverage this base as a major source of new revenue from up-sells and cross-sells.

Conclusion

Growth of SaaS companies is largely due to the shift in the way customers want their software delivered. But beyond the market demand driving growth, the structural aspects of the SaaS business model, from the SaaS recurring revenue flywheel, keeps accelerating growth. Each new SaaS customer provides incremental revenue adding more growth to the SaaS company.

Investors look to this future growth creating a long term cash-flow opportunity and reward SaaS companies with valuations over twice that of SaaP companies. The superiority of the SaaS long term business model drives much more investments in SaaS companies than SaaP companies – these investments further drive the growth of SaaS.