The finances of SaaS companies are significantly different than traditional software companies from fund raising through the exit. Venture capitalists have nearly eliminated funding on-premise software companies and have shifted their new software investments to the Cloud and SaaS companies. Private equity firms are investing in on-premise companies that are shifting to a SaaS strategy to gain increased returns on exits.

Legacy software companies such as Oracle and SAP are acquiring SaaS companies like RightNow and SuccessFactors at high multiples. SaaS companies returned 2.25 times the Price/Revenue ratio of on-premise firms on exit in Q3 2011 (Software Equity Q3 2011). It is also more difficult to sell an on-premise software company than a SaaS company. Acquiring companies often make these acquisitions to obtain SaaS technology, expertise, and SaaS customers.

SaaS companies enjoy much more predictable revenue and build up a “flywheel” of reoccurring revenue that is valued by investors and the financial markets.

SaaS Business Model Impacts: Cash Flow and Working Capital Requirements

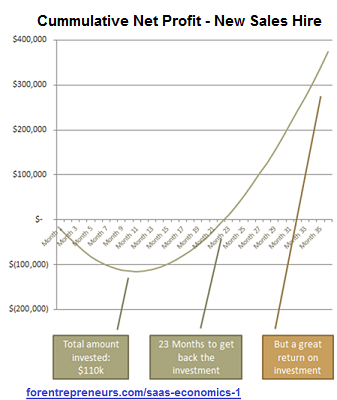

Cash Flows and the delay of Recognized Revenue are two major factors for SaaS companies. While there is great value in reoccurring SaaS revenue streams, delayed revenue impacts both the near-term profitability and the cash requirements. The faster a SaaS company grows, the lower the profits and the greater the cash requirements. Banks are beginning to finance contractual revenue streams, but primarily for their best, lowest risk clients.

Cash Flows and the delay of Recognized Revenue are two major factors for SaaS companies. While there is great value in reoccurring SaaS revenue streams, delayed revenue impacts both the near-term profitability and the cash requirements. The faster a SaaS company grows, the lower the profits and the greater the cash requirements. Banks are beginning to finance contractual revenue streams, but primarily for their best, lowest risk clients.

A key responsibility of the finance department is to determine the working capital requirements of the SaaS operation. It is critically important to model the cash requirements and the sensitivity to SaaS KPIs to ensure sufficient cash is available to bridge the gap until subscription revenues build up sufficiently to cover operating expenses. Finance must also be a part of the decision about contract terms particularly with respect to prepaid subscription revenues. Many SaaS companies are increasing the minimum months of MRR (Monthly Reoccurring Revenue) that must be paid in advance, often to 12 months and giving additional discounts for longer prepayments to bridge their working capital requirements.

SaaS KPIs

Since SaaS businesses are different from traditional software businesses, management must create a new set of KPIs that measure the business performance. Conventional management instincts applied to traditional software companies are dangerously misleading for SaaS companies. Since so much cash flow is deferred for SaaS operations, a system of KPIs that provide an “early warning” to performance problems in new and growing SaaS businesses is essential. SaaS KPIs also indicate when major investments should be made in areas such as sales and when those investments would be ill advised. The crucial KPIs include CLTV (Customer LifeTime Value), CAC (Customer Acquisition Costs), Churn, MRR (Monthly Reoccurring Revenue), CoS (Cost of Service), and TRuC (Total Revenue under Contract). Crucial ratios include CACS Ratio (Customer Acquisition Cost to Sales Ratio) and Monthly Revenue to CoS (target 10% to 20%).

SaaS Accounting and Audit Requirements

Many aspects of SaaS revenue recognition, while different, are more simple than for purchased software. Since the software cost is typically accrued monthly, there are fewer revenue recognition issues, particularly pertaining to features not yet delivered.

Since payment is only made for the features available at the time of subscription revenue is recognized there is no issue of paying a license fee; On-premise software that is licensed in a lump sum may come with the implicit assumption of future features which would result in the inability to recognize that license revenue, a major revenue recognition problem is avoided with SaaS. Obviously prepayment of SaaS services must be recognized only when the service is delivered. Audit standards SAS 70 and SSAE 16 for services organizations will need to be considered for larger SaaS organizations though the standards were not written with SaaS in mind — only broader service organizations.

SaaS accounting is more complex since there are more transactions per customer — it is essential that there are SaaS billing platforms that integrate the customer SaaS contracts and product utilization with accounting. Companies such as Zuora and Chargify help make make this process manageable for the finance organization.

Sales compensation payments also becomes more complex as sales people are compensated for sales over a longer period of time rather than at the time of a license sale. There are many variations on sales compensation packages, but the more complex compensation packages that are based on a sliding sales compensation rate for customer MRR payments of a number of years are complex to manage. Some companies simply pay a percent of the first year MRR fees to sales, but even if there is no sales compensation for MRR revenue beyond the first year, there are many more upgrades that require sales compensation. Similar revenue sharing complexity is required for partner sales that result in a series of payments for the duration of the life of the customer.

Resources:

- A comparison of SaaS versus Licensed Model Revenue and Cash Receipts – “SaaS Revenue Models Win in the Long Run“

- A discussion of best practices in Maximizing SaaS Revenue – “Maximizing Revenue for SaaS Companies is more than Customer Acquisition“

- Best practices for using Customer Lifetime Value and comparing different methods – “Don’t be a Customer Lifetime Value Simpleton.”

- How investors view SaaS business models – “Investors and Boards drive Software to SaaS.”

- Excerpt from a presentation on “Building SaaS Financial Models.”

Cloud Strategies can help you navigate the SaaS Financial complexities in many areas including SaaS Financial Models and Plans, Metrics, and Capital Requirements.

Contact Us for a free hour review of your SaaS Financial Plans and Models, and your SaaS Metrics.

Contact Us for a free hour review of your SaaS Financial Plans and Models, and your SaaS Metrics.