The SaaS subscription business model trades high upfront (license) payments for a greater Customer Lifetime Value. This increases the SaaS vendors overall value resulting company valuations over twice those of Licensed Software companies of the same revenue (Software Equity Group 2013).

The SaaS subscription business model trades high upfront (license) payments for a greater Customer Lifetime Value. This increases the SaaS vendors overall value resulting company valuations over twice those of Licensed Software companies of the same revenue (Software Equity Group 2013).

The transition from Licensed Software Models to SaaS Subscription Models for software vendors is challenging, but the long term benefits are great; particularly higher growth and higher company valuations. The greatest benefits are derived from the fact that customers are demanding SaaS and the majority of new applications are SaaS based. The growth of the SaaS market is much greater than the Licensed Software market.

Like other computing paradigm shifts: Mainframe>Mini>Client Server>Networked Computers>Internet Computing>SaaS – the transitions took time, but were unstoppable. Most of the winners in each new era were new companies, however there were innovators that succeeded in multiple computing eras. The same will be true for the transition to SaaS.

This article compares the economics of SaaS versus Licensed Software revenue models for software and SaaS vendors. A follow-on post, “SaaS Financial Models Win in the Long Run” will be published in November 2013. Subscribe to our blog and Follow us on Twitter to be notified upon publication.

SaaS Income Models are Different

SaaS income is characterized by delayed revenue and cash payments to the SaaS vendors and conversely payments by the customer. (For simplicity, professional services are not considered in this analysis). This results in a “cash crunch” in the early period after the launch of a SaaS product as well as delays in revenue recognition. This can be difficult for the startup with limited assets and problematic for a public software company managing its P&L. The delayed revenue ramp for SaaS companies is difficult to address until the “SaaS Revenue Flywheel” kicks in after several years, though the cash position of the company is influenced by its policies.

Traditional software companies gain the majority of their revenue at the time of the license purchase, though the recurring revenue stream of software upgrade and maintenance fees provides a substantial income driver for software companies with a large installed base.

Revenue Drivers

Both Software License and SaaS Models have a few essential KPIs whose performance drives revenue growth.

Driving Revenue KPIs:

| SaaS | Licensed |

|---|---|

| New Customers | New Customers |

| Initial Monthly Recurring Revenue (MRR) $ | Initial License $ |

| % Incremental Add-on Subscription Revenue | % Additional Add-on License Revenue |

| % Yearly Subscription Increase | |

| % Maintenance Fees | |

| Months Prepaid Subscription | Months Prepaid Maintenance |

| % Attrition | % Attrition |

In this article these factors are constant when in fact they will vary substantially, but unpredictably, over time.

Maintenance fees generate substantial recurring revenue for Licensed Software companies. SaaS companies have the opportunity for yearly subscription cost increases after the initial contract period. The prepayment of subscriptions by SaaS companies is essential for the financial health of the SaaS company without very large capital infusions. Most B2B SaaS companies are moving to a one year minimum subscription prepayment paid annually.

Hosting Costs/Hosting Revenue Differences

The costs of hosting the software by either the customer’s IT organization or the SaaS vendor are significant.

The yearly costs of hosting Licensed Software are typically 7% to 15% of the total License Software costs for the IT organization (and 10% to 20% of the yearly SaaS Subscription costs). SaaS vendors’ hosting costs should be lower than their customers’ IT costs due to economies of scale of running a multi-tenant operation. These hosting costs should be considered both in the customer’s ROI and the vendor’s Cost of Service.

Some Licensed Software vendors transitioning to a SaaS model will charge a separate hosting fee by the vendor or their partners — typically using an MSP (Managed Service Provider). This is generally done during a transitional period when these Licensed Software vendors have customer demand to provide a “SaaS” solution before the vendor has a complete, multi-tenant SaaS architecture. This pricing model is generally not competitive with native SaaS solutions. These separate hosting costs should be added into the total SaaS revenue for revenue analysis. The hosting costs are required to compute the Customer Lifetime Value below.

Customer Lifetime Value (CLV)

Well performing SaaS vendors will have higher CLVs (also know as CLTV or LTV) than Licensed Software vendor competitors even considering the cost of capital within a discounted cash flow model.

The theoretical value of the customer to the company (CLV) is equal to the discounted cash flow (DCF) of the payments to the company minus the Cost of the Service. The Cost of Service for both SaaS and Licensed Software vendors includes any licenses or subscription fees they pay and their customer support. Additionally, the SaaS vendor will incur significant hosting system operations costs.

Since cash received early on is vastly more valuable than cash received in the future, it is important to use DCF to compare Licensed and Subscription models.

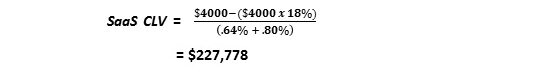

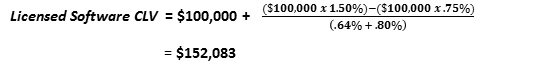

![]() The examples below compare the CLV of the SaaS and Licensed Software models. Both models use 10% Cost of Capital and 8% annual Attrition Rate.

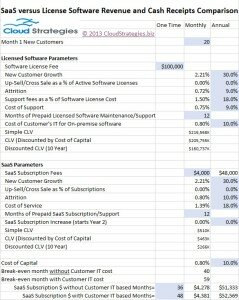

The examples below compare the CLV of the SaaS and Licensed Software models. Both models use 10% Cost of Capital and 8% annual Attrition Rate.

The SaaS monthly subscription fee is $4000. The SaaS Cost of Service (hosting and support) is equal to 18% of the subscription revenue (which is the Cost of Service reported by both Salesforce and Demandware. The gross profit of the SaaS offering is 88%.

The Licensed Software customer cost is $100,000 with 18% annual (1.5% monthly) software support and maintenance fee ($1500/month). The Licensed Software Cost of (Support) Service is 9% of the license fee ($750/month) yielding a 50% support/maintenance gross margin).

The Licensed Software customer cost is $100,000 with 18% annual (1.5% monthly) software support and maintenance fee ($1500/month). The Licensed Software Cost of (Support) Service is 9% of the license fee ($750/month) yielding a 50% support/maintenance gross margin).

With these parameters, the SaaS model’s CLV discounted for the Cost of Capital is 50% greater than the Licensed Software model.

With these parameters, the SaaS model’s CLV discounted for the Cost of Capital is 50% greater than the Licensed Software model.

These model comparisons are sensitive to changes in any of these parameters: the SaaS Subscription Price, Churn rates, Cost of Service, and the Cost of Capital.

Contrasting the Models’ Revenue and Cash Receipts

The models have high sensitivity to the essential KPIs. Managing them is critical to maximize capital and to properly plan for the cash required.

Early stage SaaS companies typically grow 30+ percent per year. SaaS Capital 2013 survey of SaaS companies over $2M in annual revenue had a median growth of 35%. The Pacific Crest Survey (2013) of SaaS companies over $2M in revenue corroborated these results with a finding of 32% annual revenue growth. By contrast, large Licensed Software vendors grow revenue at average of 10 to 11 percent per year (Software Equity Group 2013). This high growth of SaaS companies requires significant cash to fund the sales and marketing of revenue which largely won’t be realized for several years.

CLV analysis is covered in great detail in the post, Don’t be a Customer Lifetime Value Simpleton.

Months to Break-even: SaaS versus Licensed Models

Typically, the break-even point between the SaaS Subscriptions revenue to Software License plus the support, maintenance, and upgrades is 24 to 48 months for the vendor. That translate into about 36 to 60 months break-even for the IT organization when the cost of their IT organization running Licensed Software. For the example in the prior section the revenue received by the SaaS vendor matches that of the Licensed Software vendor in 40 months. Assuming the IT costs avoided by the customer in the SaaS model is equal to 10% of the Software License cost, the cost break-even point for the customer between the SaaS and Licensed Software offerings is 51 months.

The variation in this ratio is dependent on the value of the application to the customer, the price sensitivity of the market, and the desire of the SaaS vendor to gain market share rapidly through a lower pricing strategy. The SaaS vendor should target a break-even point of 30 to 42 months to achieve a reasonable time to revenue break-even while competing on price with Licensed Software vendors.

The formula for calculating the revenue “Months to Break-even” given the MRR is:

The formula for calculating the MRR given the “Months to Break-even” is:

![]()

(* Costs include maintenance, upgrade, and hosting costs as applicable)

The break-even point will be deferred further by churn in the SaaS customer base which occurs prior to the break-even point – A high churn rate extends the time to break-even.

SaaS versus License Software Model Scenario Analysis

The prior analysis in this post examined the economics from a single customer with an average churn rate. The economics of the company are based on the growth the customer base. While the break-even point for a “typical” customer may be around 3 years, the break-even for the company as a whole is much longer as new customers are added each whose break-even point is several years away.

The revenue and cash receipt break-even points vary widely based on the factors driving growth. (Cash flow break-even is discussed in the follow-on post, “SaaS Financial Models Win in the Long Run”). Three scenarios are considered below. The first two consider the same customer growth of the SaaS and Licensed Software vendors — it is atypical for a Licensed software vendor to growth at the rate of SaaS vendors, but the new customer growth is assumed to be equal for the point of comparison. Attrition is set to be the same between SaaS and Licensed Software vendors.

These scenarios are based on a $100,000 license fee plus 18% annual maintenance/support/upgrade fees for the Software Licensed model which results in a monthly SaaS subscription fee of $4278 for a 36 month revenue break-even. From the SaaS customer perspective, assuming the cost savings of eliminating the annual IT expenses associated with On-premise software estimated at 10% of the license cost, their SaaS expenses will equal the Licensed Software total expenses after 50 months.

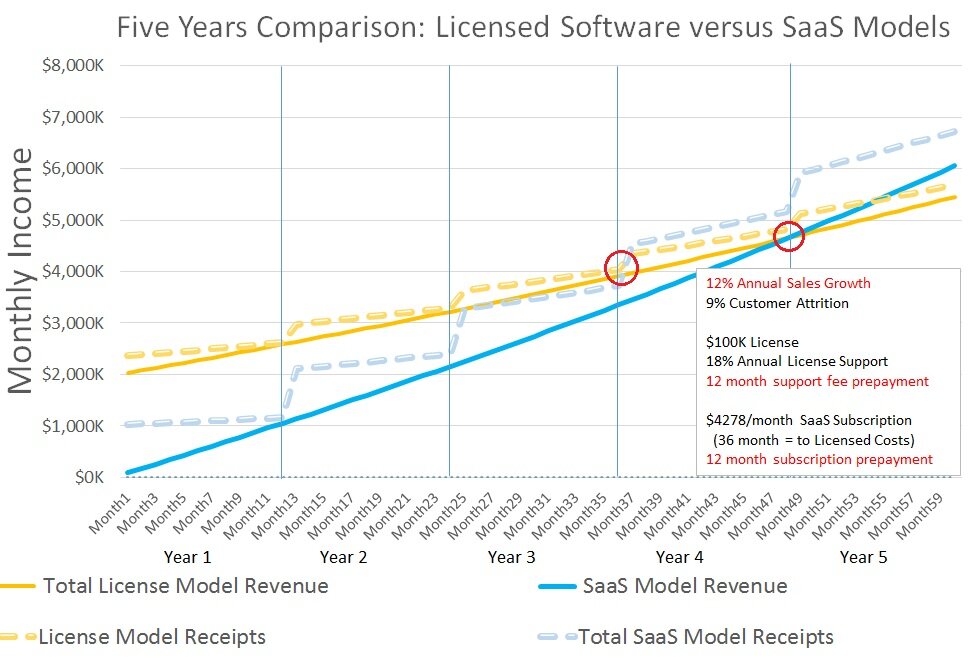

Moderate Growth Scenario:

This scenario uses a 12% growth in annual licensed revenue which is above average for a Licensed Software company, but lower for a SaaS company (SaaS Capital, 2013, Software Equity Group). Many SaaS companies have a much smaller revenue stream so large percent increases are easier to achieve. For comparison purposes, this scenario assumes the same 12% growth under both models.

In this scenario, cash receipts for the SaaS company exceeded those of the Licensed Software company after 3 years. This is dependent of the relative pricing between the license fees and the subscription fees. The revenue of the SaaS model surpassed the Licensed Software model after 48 months.

The earlier cash receipt break-even is a result of the 12 month SaaS subscription prepayment. If there is no prepayment of subscription or maintenance fees, the cross over point for cash receipts will be delayed until the revenue break-even point (ignoring the delay in collecting receivables).

High Growth Widens Gap for SaaS Income and Cash Receipts

Surveys show mid-size SaaS companies median growth is over 30% per year. This scenario shows a 30% growth in both models results in revenue and cash receipts exceeded by the Licensed Software model indefinitely. This is unlikely to be realistics since Licensed Software companies are not experiencing the same growth as SaaS companies.

In this scenario, the cash receipts of the SaaS company match those of the License Software vendor after 73 months, but the revenue never meets the same level as the License Software vendor.

With greater cash receipts and a much higher valuation, this is still a much better position for the SaaS vendor in this unlikely scenario that the Licensed Software vendor can match the growth of the SaaS vendor.

Additional Upsides in the SaaS Model

SaaS models have key attributes that significantly improve the SaaS cash flow and revenue models contrasted with Licensed Software models:

Annual Subscription Price Increases

B2B SaaS subscriptions often are increased each year. Often there is a contractual commitment for a fixed pricing level for one, two or three years. Customer and SaaS Vendors often agree in the initial contract to limit the subscription price increases to the CPI (Consumer Price Index) or a fixed amount (typically no more than 5% per year).

Land and Expand

SaaS customers are also more likely to add-on additional subscriptions within the same SaaS service (Up-sell) or with new SaaS services (Cross-sell) than Licensed Software customers. This “Land and Expand” strategy has most famously been used by Salesforce — two thirds of their revenue is believed to be derived from up-selling and cross-selling into their base accounting for the majority of their revenue base. Customer Engagement Analytics only feasible with SaaS offerings allowing vendors to much more readily determine expansion sales opportunities by tracking the engagement of their SaaS subscribers providing essential insights into additional revenue opportunities with their customer base.

The ease of “trying out” and adding SaaS offerings leads to a greater revenue from the customer base for most SaaS vendors as described in the post “Maximizing Revenue for SaaS Companies is more than Customer Acquisition.”

SaaS Customer Growth is Higher

For the sake of comparison, both these models have shown the same growth in the number of new customers as well as the growth from the customer base as described above. In many markets, most new sales are moving to SaaS resulting in a higher growth rate in customer acquisition for SaaS companies.

Lower Discounts

While SaaS and Licensed Software discounts vary widely, SaaS is usually discounted less since the early financial commitment is less. Anecdotally, Licensed Software discounts on large purchases may be twice the SaaS discounts.

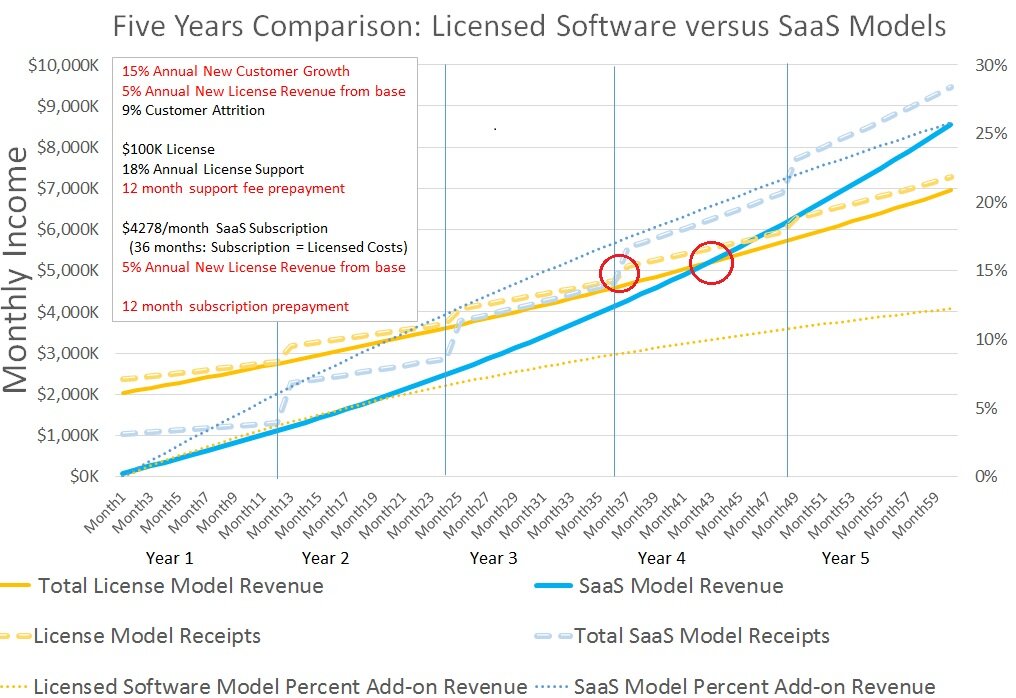

SaaS Optimized Scenario

This scenario takes into account the higher growth add-on revenue into the customer base achieved by SaaS vendors versus License Software vendors and annual subscription price increases by the SaaS vendor — a more typical scenario. This scenario models the same 15% growth in the number of new customers b Licensed Software and SaaS vendors, but assumes the annual sales of add-on licences by the Software License vendor is 5%, while the SaaS vendor grows its subscription revenue by 15% annually. The model also assumes a 4% annual increase in the cost of SaaS subscription fees.

In this scenario, the cash generated by the SaaS company exceeds the Licensed Software company after 2 years; the revenue is exceeded after 33 months. By year 5, 36% of the SaaS vendors revenue is derived from add-on sales to its existing customers.

With these reasonable assumptions of additional revenue from the installed base, SaaS vendor has a cash receipts advantage over the Licensed Software vendor. Hypergrowth of the SaaS vendor still will require a lot of cash since the sales and marketing costs to drive that growth are substantial as covered in the upcoming post, “SaaS Financial Models Win in the Long Run”.

SaaS Businesses have Greater Value but require more Cash and Patience

SaaS companies will garner less revenue in their early years, but that revenue will begin to catch-up with Licensed Software companies after several years due to the increased recurring revenue derived from the SaaS company customers and their ability to gain incremental revenue gains from their customers every year.

Paradoxically, the higher the growth the greater the longer it will take for the SaaS company to achieve the same revenue as the Licensed Software company with similar customer growth though it is very rare for a Licensed Software company to grow at the same rate as a SaaS company. This is due to a high growth SaaS company has many newer customers who have not yet generated much revenue for the SaaS company. With very high growth, revenue (and profits) are secondary — the equity markets reward SaaS growth more than profits.

SaaS companies can match the Cash receipts of Software companies after several years, but it is essential to have prepaid subscription fees of at least a year to make the cash flow work.

These models do not consider the impact on cash receipts due to time to collect receivables. Licensed Software vendors’ receivables collections are generally longer and there are more uncollectable receivables since the upfront amounts are greater. SaaS companies can interupt the SaaS service in severe cases of non-payment — an option Licensed Software vendors do not have. This has a positive impact on cash receipts for the SaaS vendor not considered in this model.

Attrition must be kept under control since it is in the later years when revenue and cash receipts match Licensed Software companies — if those SaaS users don’t stick around, they won’t be there to generate the revenue and cash to make the long term SaaS model work.

These models assume identical grow of SaaS business and Licensed Software businesses. While this is in part due to the fact that SaaS companies are generally smaller and hence have a greater ability to grow than their larger Licensed Software competitors, the overall SaaS market is growing much faster than the Licensed Software market. The market data shows that most SaaS sales grow much faster than Licensed Software sales due to market shifts and customer demand.

These models assume identical grow of SaaS business and Licensed Software businesses. While this is in part due to the fact that SaaS companies are generally smaller and hence have a greater ability to grow than their larger Licensed Software competitors, the overall SaaS market is growing much faster than the Licensed Software market. The market data shows that most SaaS sales grow much faster than Licensed Software sales due to market shifts and customer demand.

The payoff is that based on public Software and SaaS company valuations provided by Software Equity Group, median SaaS Price/Revenue ratio for a SaaS company is more than twice that of a Licensed Software company. Even with somewhat lower revenues, the shareholder value for SaaS companies is substantially greater than for Licensed Software companies.

The transition to SaaS is not simple, cheap or assured for Licensed Software companies, but the payoff for success is substantial. Pure play SaaS companies should also closely compare their revenue model with those of their Licensed Software competitors — their prospects certainly will.

Assistance in creating SaaS Business and Financial models can be obtained by contacting [email protected].