The Bad News

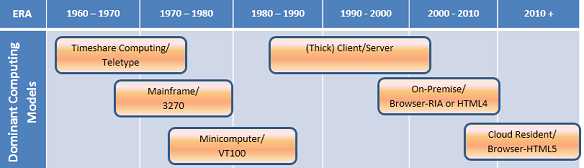

Cloud Computing is just the latest computing model fostering the creative destruction of the prior dominant computing model: Mainframes to Mini Computers, Mini Computers to Local Area Networks, Local Area Networks to Client Server, Client Server to On-premises Browser Based, On-premises Browser based to Cloud Applications. At each transition, expensive capabilities are commoditized, complexities are eliminated, and previously exotic applications became mainstream. Each new model resulted in a larger total Information Technology (IT) market even though the cost of specific function declined. These sea changes in technology models led to new wealth for the innovators and disaster for the laggards (remember DEC?).

Cloud Computing is just the latest computing model fostering the creative destruction of the prior dominant computing model: Mainframes to Mini Computers, Mini Computers to Local Area Networks, Local Area Networks to Client Server, Client Server to On-premises Browser Based, On-premises Browser based to Cloud Applications. At each transition, expensive capabilities are commoditized, complexities are eliminated, and previously exotic applications became mainstream. Each new model resulted in a larger total Information Technology (IT) market even though the cost of specific function declined. These sea changes in technology models led to new wealth for the innovators and disaster for the laggards (remember DEC?).

The changes brought about by SaaS (Software as a Service) to the software industry in the paper are described in “Why SaaS Growth is Exploding”. The Partners of these software companies are also experiencing radical changes with SaaS moving to become the dominant software model. Those Partners include Value Added Resellers (VARs), Distributors such as Ingram Micro, Large Consultancies/System Integrators such as Accenture, Deloitte. While the business models of each of the SaaS vendor Partners are different, the underlying disruption and opportunities are similar.

The changes brought about by SaaS (Software as a Service) to the software industry in the paper are described in “Why SaaS Growth is Exploding”. The Partners of these software companies are also experiencing radical changes with SaaS moving to become the dominant software model. Those Partners include Value Added Resellers (VARs), Distributors such as Ingram Micro, Large Consultancies/System Integrators such as Accenture, Deloitte. While the business models of each of the SaaS vendor Partners are different, the underlying disruption and opportunities are similar.

The net revenue received by these Partners for a given set of application capabilities contained in ERP or CRM will decline with the transition to the Cloud while new capabilities will arise to expand the total IT spend.

The Cloud shifts many IT responsibilities away from the customer and the Partners that support them to the SaaS, PaaS (Platform as a Service), and IaaS (Infrastructure as a Service) vendors. Software Partners have been disintermediated from some less complex Cloud applications as fewer services are required for installation and upgrades and early SaaS startups have tended to adopt an initial direct sales strategy. Modern SaaS applications also have much better “customer self-service” reducing revenue for these tasks.

The adoption of the SaaS model by SaaS vendors and their Partners defers their cash receipts compared with licensed On-premises applications. While the Customer Lifetime Value (CLV) is greater for SaaS vendors and their Partners, the balance sheet implications of these delays of customer payments must be addressed.

Software Partners who cling to On-premises applications will see their revenue drop precipitously as the transition from On-premises applications accelerate.

The Good News

The paradox is that despite expensive products and services being replaced by less expensive solutions with every new computing model, the overall spend has increased with each generation. Mainframes were much more expensive than mini computers, but the market for mini computers became much larger; Networked computers were much cheaper than DEC VAXs, but that market was also much larger.

The paradox is that despite expensive products and services being replaced by less expensive solutions with every new computing model, the overall spend has increased with each generation. Mainframes were much more expensive than mini computers, but the market for mini computers became much larger; Networked computers were much cheaper than DEC VAXs, but that market was also much larger.

While the drop in per user revenue for a specific SaaS application looks to be bad news, those that embrace the revolution will have new Cloud revenue opportunities that surpass the On-premises software model. Service providers will see the greatest revenue potential both in capturing a larger share for SaaS subscriptions than their competitors while selling additional service offerings to setup, configure, and integrate SaaS software with other software.

The cost efficiencies gained by companies moving to the Cloud will allow customers to shift resources to new, high value initiatives particularly big data/analytics, social media, and mobile computing. Additionally, customers have no choice but to find additional funds to address the relentless increase in compliance costs. SaaS companies and their Partners will benefit from the shift of IT resources from low value functions (local hosting, lengthy installation, complex upgrades) to these new high value, high profit services for their customers.

Software Vendor Partners Actions:

The proactive Partner will prudentially size the Cloud opportunity with initiatives such as:

1) Use SaaS to capture competitor’s customers: The first opportunity is to take business away from those vendors and their Partners that cling to the old On-premises model. Companies where SaaS vendors and the Partners couldn’t previously break into are now accessible with new SaaS offerings.

2) Help customers consolidate their applications with SaaS: Many IT organizations have a diverse set of unintegrated applications that have been installed over the years. These disparate applications provide an opportunity for consolidation increasing the Partner presence in the organization. For example, IT focused VARs can expand into Cloud based Unified Communication with VOIP displacing On-premises PBX and call center systems.

3) Partner with growing SaaS companies as they expand their channels: SaaS companies that started with a direct-focused sales strategy such as Salesforce and NetSuite are expanding their channels aggressively – their channel sales are growing even faster than their direct sales. Take advantage of their strategic thrust to building their channel organization by partnering with these high growth companies – the percent of their sales through the channel is increasing.

4) Broaden the scope of new services and applications: There are new strategic initiates that weren’t previously feasible for companies to undertake. Enable your client’s new mobile, big data/analytics, and social initiatives with new products and services.

5) Provide additional higher value services: Compliance is a very high growth area for many companies that cannot be deferred. SaaS applications can assist in compliance initiatives since much of the compliance work is shifted to the SaaS vendor and its Partner; That requires new Partner expertise and new Partner relationships. Higher value business process optimization can now have renewed emphasis as the channel moves from mundane installation and upgrade processes to higher value services.

6) Provide Cloud expertise to IT: The Cloud is both making organizations rethink which IT functions they perform in-house, and requires them to find expertise in transitioning to Cloud IT models. VARs and Consultancies can profit by providing expertise in the Cloud transition and providing Cloud centric IT expertise to companies outsourcing much of their IT to the Cloud.

Finally, while the Cloud has taken greatest hold in small and Medium Businesses (SMB), the Cloud transition is now gaining momentum in larger organization more predisposed to significant services expenditures.

How SaaS Companies can Help Drive their Partners’ Success

SaaS companies should foster the success of their Partners that are already moving or are primed to move to the Cloud model. The SaaS companies must create a partner model that ensures mutual success for those Partners that “get it”.

SaaS companies should foster the success of their Partners that are already moving or are primed to move to the Cloud model. The SaaS companies must create a partner model that ensures mutual success for those Partners that “get it”.

There are three castes of SaaS company Partners:

- Forward thinking Partners who are ready to move their practice to embrace the Cloud

- Laggard Partners that wish the world wouldn’t change

- New Partners where a new relationship with the SaaS vendor is enabled by the Cloud

The approach to Partners is the same as for employees in the transition to the Cloud. 1) Support those who “get it” in the transition to the Cloud, 2) Ease out those who won’t/can’t make the transition to the Cloud, and 3) Recruit new Partners (and employees) that are attracted by the Cloud strategy.

SaaS vendors need to help educate their Partners on the best practices for succeeding in the SaaS world. This includes supporting training and helping Partners work through their business model and cash flow to ensure they can be successful. SaaS vendors should devise SaaS contract terms to provide sufficient up-front payments to make the Partner’s business viable in the short term before long term reoccurring revenue benefits are realized. SaaS vendors should assist in sales and marketing strategies in a SaaS world to ease selling costs. This also requires supporting demonstrations and trial usage as appropriate for use by the customer.

The Partner networks are increasingly important to SaaS vendors as they move to larger customers with the need for more services. SaaS vendors also need to keep their sales costs low given the revenue stream deferrals – SaaS Partners are an important part of this strategy. For newer, pure-play SaaS companies just establishing these new Partner relationships, it is crucial to minimize channel conflict and make sure the VARs and Consultancies get early wins.

The transition to the Cloud for all size organizations creates great opportunities for Partners that embrace the new computing paradigm and leave the old models behind. Those VARs and Consultancies that establish business relationships with SaaS companies and obtain Cloud expertise in their organization will have great opportunities to succeed in the Cloud era. The computing industry is replete with examples of companies that died sticking to computing models from the last era while those that led the charge to the new model thrived.